Hsa Limits 2025 Over 55 - 2025 Hsa Contribution Limits Over 55 Spouse Rosa Shelby, The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families. Health fsa contribution limits 2025 over 50. Increase in 2023 HSA Contribution Limits Fisch Financial, The maximum hsa contribution amounts for 2025 are: $4,150 (+$300 over prior year) family plan:

2025 Hsa Contribution Limits Over 55 Spouse Rosa Shelby, The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families. Health fsa contribution limits 2025 over 50.

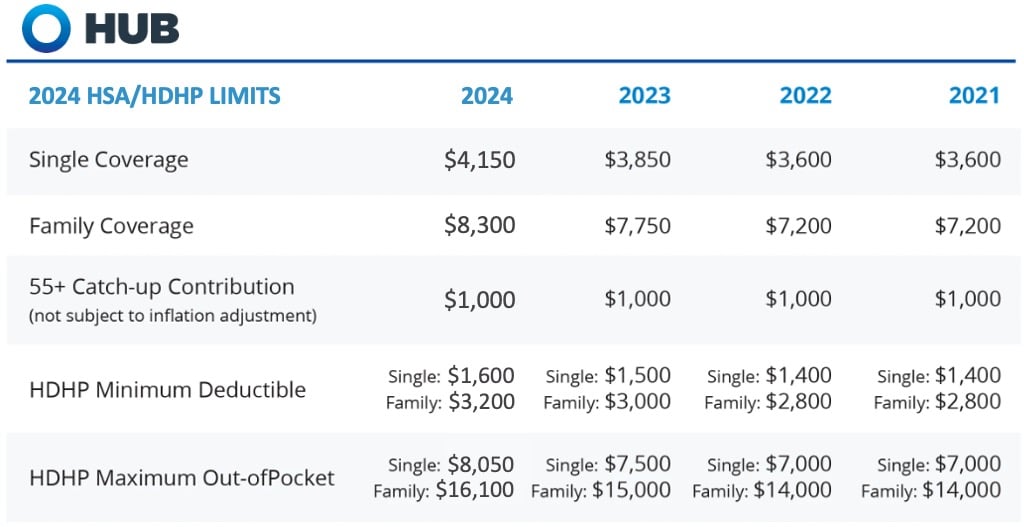

Increase in 2023 HSA Contribution Limits Fisch Financial, For family coverage, the hsa contribution limit has jumped to $8,300, a 7.1% increase from the 2023 limit of $7,750. Similar to iras and 401ks, there are catch up contributions for those age 55 and over.

Under section 80d of the income tax act, 1961, individuals and hindu Your contribution limit increases by $1,000 if you’re 55 or older.

IRS Releases 2023 HSA Contribution Limits Alegeus, 31, 2025, remains at $1,000. This means that an individual can contribute up to $4,150 to their hsa for the year.

You are responsible for ensuring your contributions do not exceed the annual limit.

2025 Hsa Contribution Limits Over 55 Over 60 Emyle Francene, The 2025 hsa contribution limit for family coverage (employee plus at least one other covered individual) increases by $550 to $8,300. The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families.

Hsa Contribution Limits 2025 For Married Couples Over 55 Alla Lucita, Hsa contribution limits for people 55+ individuals who are 55 or older may be able to contribute an additional $1,000 to their hsa in 2025. Employer contributions count toward the annual hsa.

Under section 80d of the income tax act, 1961, individuals and hindu

Famis Limits 2025 Lotta Diannne, (people 55 and older can stash away an extra $1,000.) the 2025 caps were adjusted from this year’s limits of $3,850 for individuals and $7,750 for families. The $300 contribution limit increase for individuals is the largest ever.

2025 Hsa Contribution Limits Irs Eada Rhodie, The 2025 calendar year hsa contribution limits are as follows: Individuals enrolled in an hdhp can contribute $4,150, a 7.8% increase from the 2023 limit of $3,850.

Tabela Atualizado Irs 2023 Hsa Imagesee vrogue.co, (people 55 and older can stash away an extra $1,000.) the 2025 caps were adjusted from this year’s limits of $3,850 for individuals and $7,750 for families. This additional contribution amount remains unchanged from 2023.